Research & Development Tax Credit

$

research & development tax credit

You've invested in your business, it's time to claim your credit.

The R&D tax credit is available to any U.S. business that spends time and resources on new development, improvements, or technological advancements in effort to improve upon its products or processes. The credit can also be available to American Business owners that have improved upon the performance, functionality, reliability or quality of existing products or trade processes.

encouraging innovation for

Businesses Across the Nation

The R&D tax credit is now available to any U.S. business that spends time and resources on new development, improvements, or technological advancements in effort to improve upon its products or processes. The credit could also be available to American Business owners that have improved upon the performance, functionality, reliability, or quality of existing products or trade processes.

Pathway to the

PATH Act of 2015

In a temporary effort to boost the economy in 1981, the federal government sought to use the passage of the Research and Experimentation tax credit to reward businesses for investing in research.

Recognizing the need to create jobs domestically and maintain global economic competitiveness, Congress has extended the R&D tax credits more than a dozen times over subsequent years, finally making them permanent with the passage of the PATH Act of 2015. In addition to becoming permanent, the Protecting Americans from Tax Hikes act expanded R&D credit provisions to start-ups and small businesses.

-

1981

-

2001

-

2006

-

2014

-

2015

-

2016, 2018

frequently asked questions

About the R&D Tax Credit

What's the benefit?

The R&D tax credit creates money that goes back in your company’s pocket to fuel further innovation and growth.

Why haven't I heard of this?

The credit has been around since 1981, but many companies couldn't take advantage of the tax incentive until 2015.

Is this too good to be true?

No! The R&D Tax Credit was created for businesses so they can spend more money on technology based innovations. With the recent changes, small and medium sized businesses are now able to claim the credit easier than ever.

What types of expenses might qualify?

Wages paid to employees for qualified services

This includes amounts considered to be wages for federal income tax withholding purposes.

Basic research payments

Payments made to qualified educational institutions and various scientific research organizations, allowable up to 75% of the actual cost.

Supplies

This may include any property not subject to depreciation used and consumed in the R&D process.

Third party contract expenses

This includes expenses for performing QRAs on behalf of the taxpayer, regardless of the success of the research, allowable up to 65% of the actual cost.

What type of R&D activities qualify?

The R&D tax credit may apply to any taxpayer that incurs expenses for performing Qualified Research Activities (QRA) on U.S. soil. The credit is a percentage of qualified research expenses (QRE) above a base amount established by the IRS in a four-part test:

Technological in Nature

Activities must fundamentally rely on the principles of physical or biological science, engineering, or computer science.

Permitted Purpose

Activities must be performed in an attempt to improve the functionality, performance, reliability, or quality of a new or existing business component.

Eliminate Uncertainty

Activities intended to discover information that could eliminate technical uncertainty concerning the development or improvement of a product.

Experimentation

All of the activities must include a process of experimentation including testing, modeling, simulating, systematic trial and error.

Qualifying Industries

Many small to midsized businesses fail to claim the research and development tax credit simply because they don't realize their operations qualify. Any company that develops new or improved products, processes, or software could qualify. These industries have qualified for the R&D Tax Credit:

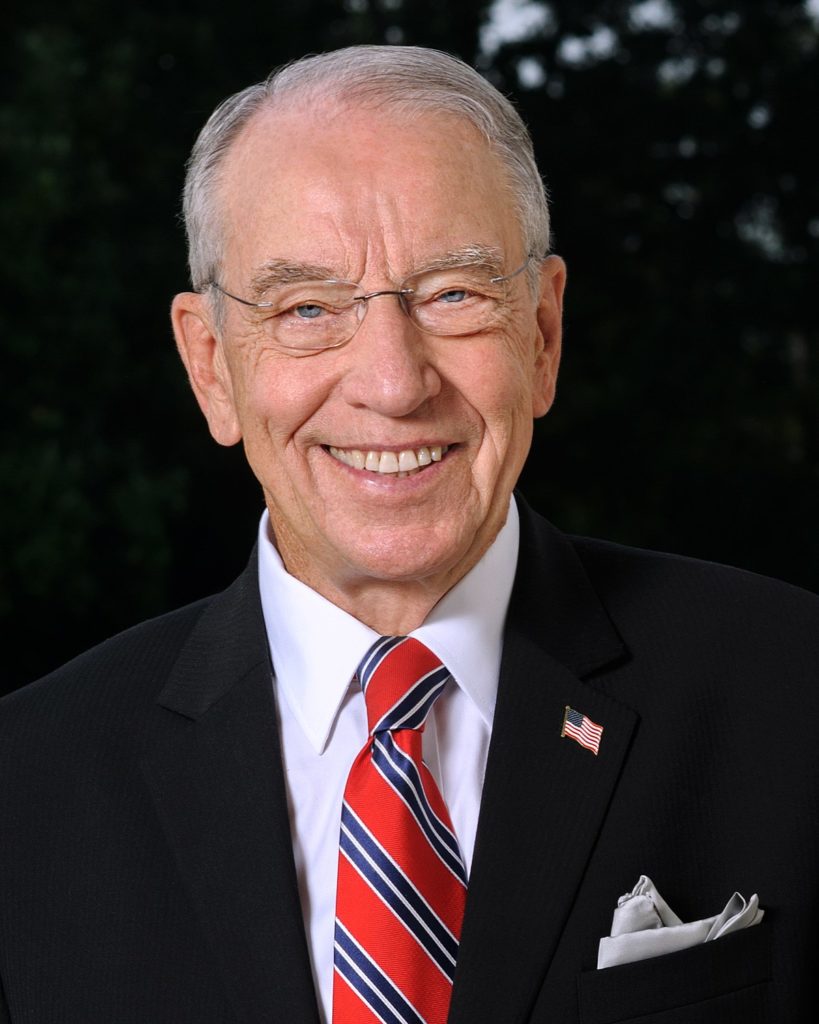

"Too often small and medium businesses just simply are not taking advantage of the R&D... 90% of life is just showing up. The same is true with tax. Business owners should learn about the tax incentives available for you. These incentives can help your business succeed and thrive."

- Senator Chuck Grassley, speaking about the R&D tax credit

Hear the full speech.

Recent Tax Credit Examples

Frequently Asked Questions

About the Research & Development Tax Credit

No! The R&D Tax Credit was created for businesses so they can spend more money on technology based innovations. Fortune 500 companies have been utilizing this for decades but with the recent changes it had, medium and small businesses are now able to claim the credit easier than ever.

Most companies could not claim the credit until 2015 when the PATH act was passed. Even companies that could claim the credit and knew about it, simply wouldn’t because of the time constraints and complexity of it all. The truth is 95% of eligible businesses still do not utilize the R&D Tax Credit.

The history matters because it is a bill that has had 15 different provisions meaning it is an evolving tax credit, but also because in 2015 congress passed the PATH act making it permanent in the tax code. This Tax Credit is NOT going anywhere and can be utilized each year moving forward.

Each year that goes by is another year that business owners are not able to save at least $19,250 (77% of $25,000, which is the minimum threshold LA will do).

Additionally, if the client has filed for an extension and has not paid their taxes for the year, then they are eligible for us to go back another year, making it 4 possible years of recovery. The quicker you start, the more you’ll be able to save in the future.

A QRA is a qualified research activity that is what the IRS and LA use to identify where you can recover money. They keep the idea bland because every different industry can use different processes that help them qualify for the credit.

The IRS establishes if your proposed QRA qualifies by putting it through their four-part test. Is there an elimination of uncertainty, was there a process of experimentation, was the process technological in nature, and did the process have a qualified purpose.

A QRE is a Qualified Research Expense that is all the expenses related to developing, maintaining and utilizing that specific QRA. Examples can be wages paid to employees to perform the qualified tasks, basic research payments, supplies necessary for conducting the qualified research and development, or a percentage of the compensation paid to contract employees for conducting the QRA.

Our team has 18 CPAs, four technical underwriters, and two tax attorneys who look at each report and make sure each QRA that is documented is credible and written the correct way. We were also the #1 R&D Back Office Team in the nation last year from doing over $100 million in recoveries.

We record the interview call because that call is then transcribed and sent to our team of technical writers who then write out a lengthy legal report detailing each QRA and how it qualifies under R&D. We can also use the recorded call to provide proof if any complications were to arise at any stage of when we file for the R&D Credit.

Forms 6765 and 8974 will layout if your CPA has already filed you for the R&D Tax Credit.

Each call you have in the information gathering stage and the feasibility study we do to see if you are a good candidate is free of cost. Then, our fee, if we see you’re a good candidate is 33% of the recovery, and we ask that 50% of that 33% that we would receive from you is paid before the recovery happens.

The simple answer is no. We understand why your CPA would say that because this is a very technical and lengthy process that if it is NOT done with the right team (which your CPA most likely does not have) then you will find yourself getting into trouble with the IRS.

Most CPA’s also do not provide enough supporting documentation, which could lead the IRS to believe something wrong has happened. We pride ourselves in having an overqualified team that will not run into these problems because we intentionally use a conservative estimate in your recovery each year.

If you do get audited, our team will defend you 100% – no matter the recovered amount. There will be no personal liability that the client will have to hold.

Your CPA most likely hasn’t told you about this because they are not able to do this kind of a process by themselves. It takes a team like the one we have here and even with the team we have, it is still a lengthy and technical process.

Additionally, CPAs understand that if they don’t file it correctly, then there is a great amount of liability on their shoulders, for a small return for themselves.

Once our team has all the information from you that we need it will generally take us 3-4 weeks from when we sign the Letter of Engagement, and you will receive your recovery from the federal government in around 18-24 weeks and from the state government in 10-12 weeks.

Not only are we able to look back three years and see what you can recover from the past, but we are also able to file every year moving forward if you end up qualifying for the credit. Don’t be tunnel visioned in thinking about the past three years when you can think about the next 10.

Yes, we gather all of your information and put together a lengthy report (dependent on the amount of QRA’s you have) and prepare the Research & Development tax credit.

GOOD: If a Business pays taxes, has W-2 Employees and if they’re profitable.Businesses that hold patents. Publicly traded companies. If they have been in business for more than three years.

BAD: Sole Proprietorship and LLC are generally not good candidates. Restaurants, Law Firms, Accounting Firms, Beauty Salons, Mortgage Companies and Insurance Agencies. (There are always exceptions with these industries, as well.)

Yes. Even processes that you put money, effort and wages to that did not work for your specific business qualify as long as you were attempting to develop a new or improve upon an existing system by helping it in areas of function, performance, reliability or quality.

You could be leaving thousands of dollars behind.

Many misconceptions surrounding the new regulations are that it is difficult to apply for the credits and that it is restricted to a small group of industries. This could not be further from the truth.

The business tax incentive process is easier to navigate and you may be able to go back three years to file for credits that were earned but not claimed. Now is the time to work through the Business Qualification Process and see if you have left some valuable business incentive credits on the table.